Included in the report on the financial performance were the following LinkedIn highlights: But it seems as plausible that strategists will be cheering on prices from higher peaks-constructively, of course.Yesterday, Microsoft announced Q1 FY21 Earnings. So why would stock prices not melt up elsewhere? Perhaps Wall Street’s year-ahead notes for 2022 will survey the wreckage of a stockmarket bust in America. The case for owning stocks at these prices depends on low interest rates. Mr Grantham’s note is well worth reading.

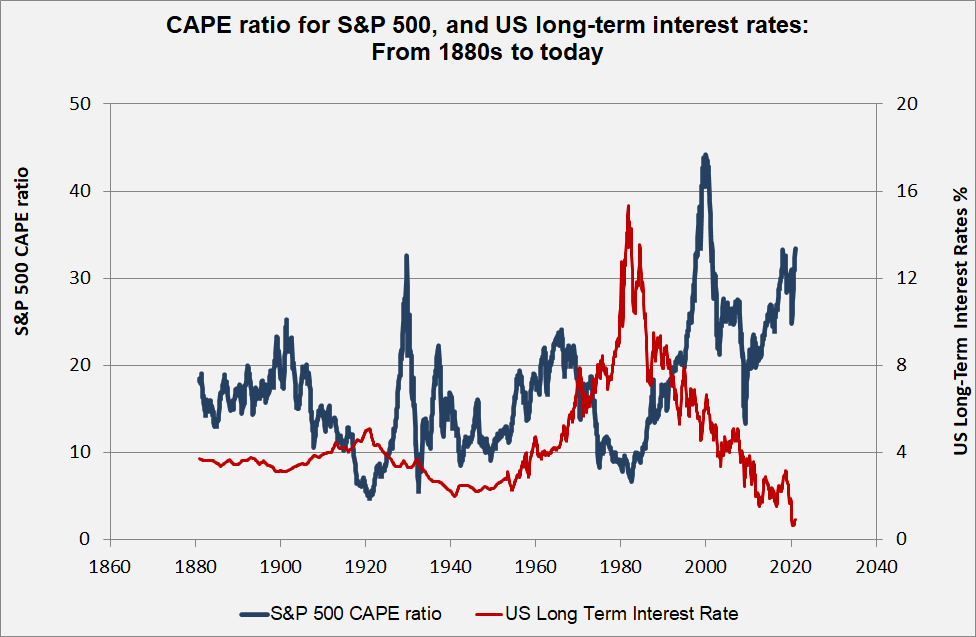

“My best guess as to the longest this bubble might survive is the late spring or early summer,” he writes, and advises seeking refuge in cheap emerging-market stocks. In a note this week Jeremy Grantham, co-founder of GMO, an asset manager, argues that stocks in America have already gone too far. The other is the paucity of yields on offer from bonds. The fact that recession has hurt small unlisted businesses more than large listed firms is one part of the story. A terrible year for the economy still produced positive returns in many stockmarkets. On a closer look, then, many of the obstacles to the stockmarket’s upward march do not seem so formidable. But demand for liquid safe assets tends to stay high after crises. A related concern is that the explosion in public debt will eventually push up real interest rates. Such low borrowing costs make debt burdens easier to carry. The spread over Treasuries is about as low as it was in 2006, when wider credit conditions were dangerously easy. Central-bank buying of corporate bonds has kept financing costs remarkably low for companies with access to wholesale capital markets: just consider the cost of borrowing for companies with debt rated BBB, the riskiest investment-grade rating. The increased debt load will drag on companies’ finances and could in turn weigh on equity prices. Companies borrowed heavily to ensure they had enough cash to withstand the revenue losses from lockdowns. There are other hangover effects from the pandemic to consider. If the pattern of modestly above-target inflation expectations, a relaxed Federal Reserve and steady real yields stays intact, it may well boost equity prices, not retard them. But yields on inflation-protected Treasuries have barely budged-and it is these real yields that are the benchmark for stockmarket valuations. This upward creep does reflect higher market expectations of inflation, which are now above 2% in America. Bond yields have been edging up for months: this week the ten-year Treasury yield exceeded 1% for the first time since March 2020. Nor is it obvious that bond markets will react so violently as to fatally undermine stock prices.

A sustained burst of higher inflation-and one that forces central banks into abruptly raising interest rates-appears less so. A dynamic of this kind has been playing out in commodity markets: a revival in industrial demand (notably from China) for copper and iron ore has bumped up against supply constraints and led to a run-up in prices.Ī temporary bout of inflation seems plausible. With enough bottlenecks, a surge in spending could drive up inflation. Meanwhile recession has also taken out supply capacity: a lot of small firms (and some large ones) have gone under. Lockdowns and fiscal transfers have left rich-world consumers with extra savings and a lot of pent-up demand-fuel for a post-pandemic spending spree. Yet another risk, and one that keeps some market bulls awake at night, is resurgent inflation. In Europe the boost from the €750bn ($920bn) recovery fund should start to be felt from the middle of the year. The loss of the Republican majority in the Senate may open the door to further fiscal easing. In America the $900bn fiscal package passed after Christmas will add two percentage points to GDP growth in 2021, reckon economists at JPMorgan Chase, a bank. So far, though, there is little sign of this. A natural concern is that stimulus might be withdrawn abruptly, as it was after 2010. What if policymakers change tack? Continued fiscal support requires political action and agreement, which cannot always be relied upon. Indeed, 2018 began with much talk of a market melt-up, but ended with heavy stockmarket losses.Ī lot of the current optimism rests on the idea that policy will continue to support the economy. Paradoxically, positive sentiment is often seen as a reason to be wary, and that investors have got ahead of themselves. A large majority think the world economy is in the “early-cycle” phase (ie, that there is a long runway of growth ahead). The last time fund mangers were this optimistic about the scope for stockmarket gains was January 2018, according to a monthly survey by Bank of America done in December.

0 kommentar(er)

0 kommentar(er)